The chancellor is under pressure because movements in financial markets have raised the cost of government borrowing, jeopardizing Rachel Reeves’ economic plans.

So what’s going on? Should we be worried?

What is a bonus?

UK Treasury bonds, known as gilts because they used to literally have gold edges, are the mechanism by which the state borrows money from investors.

They pay a fixed annual yield, known as a coupon, to the lender over a fixed period (five, 10, and 30 years are common durations) and are traded on international markets, meaning their value changes even when the yield remains fixed.

Money weblog: Major mobile phone company will increase its bills next month

That means your true interest rate is measured by the “yield,” which is calculated by dividing the annual yield by the current price. So when bond prices fall, the yield (the effective interest rate) rises.

And for the past three months, markets have been selling off UK bonds, driving up borrowing costs. This week the yield on 30-year bonds reached its maximum highest level since 1998 at 5.37%, and Ten-year bonds briefly reach level last seen after the financial crisis, causing nervousness in the markets and in Westminster.

Why are investors selling UK bonds?

Bond markets are influenced by many factors, but the main internal pressure is the prospect of persistent inflation, with interest rates staying higher for longer as a consequence.

Higher inflation cuts the purchasing power of the coupon and higher interest rates make the bond less competitive because investors can now purchase bonds paying a higher rate. Both apply in the UK.

Inflation remains higher than Bank of EnglandThe 2% target is on target and many large companies are warning of further price increases as tax and wage increases hit in the spring.

As a result, the Bank is now expected to cut rates just twice this year, as opposed to the four reductions that markets had already priced in in November.

There is also little optimism that the economic growth promised by the chancellor will save the situation in the short term, with business groups warning that investment will be tempered by taxes.

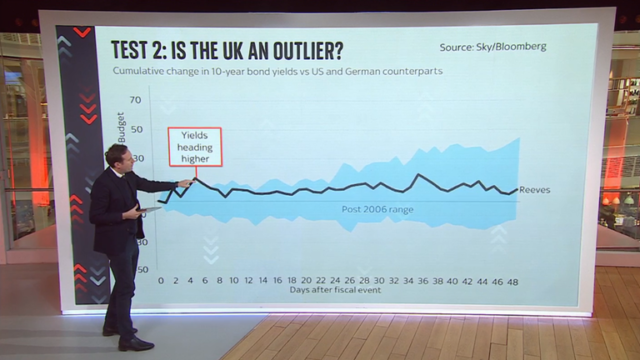

Is the UK alone?

No. Bond markets are international and in recent months the main influence has been the increase in borrowing costs in the United States, caused by the re-election of Donald Trump and the assumption that tariffs and other policies will be inflationary.

The United Kingdom is not immune to those forces, and other European nations, including Germany and France, facing their own political shifts, have also seen costs rise. (U.S. influence could still increase if Friday’s strong labor market numbers reinforce the sense that rates will remain high.)

But there are specific internal factors, particularly the prospect of stagflation. The UK is also more reliant on foreign investors than other G7 countries, meaning markets really matter.

Why does Reeves care?

The cost of borrowing affects not only the issuance of new debt but also the price of servicing existing loans, and is important because these higher costs could erode the “margin margin.” Mrs. Reeves It stayed within its budget.

Headroom is a measure of how much slack it has from its self-imposed fiscal rule, which itself aims to reassure markets that the UK is a stable place for investment, to fund everyday spending entirely from tax revenues by 2029. -30.

On budget it had just £9.9bn of margin and some analysts estimate that market pressure has eroded all but £1bn of that margin.

Read more:

Influential union leader announces retirement

Food prices to rise due to rising budget taxes, retail body warns

In late March, the Office of Budget Responsibility will provide an update on the fiscal situation and market conditions could change before then, but if they don’t, Reeves may have to rewrite his plans.

The Treasury this week described the fiscal rules as “non-negotiable”which leaves the choice between raising taxes or, more likely, reducing costs to make the numbers add up.

Why do the rest of us care?

Persistently higher rates could raise consumer debt costs, increasing the burden of mortgages and other loans. Beyond that, the state of the economy matters to all of us.

The underlying challenges – persistent inflation, stagnant growth, worse productivity, poor public services – are fundamental and the Labor Party has promised to address them.

Investments in infrastructure and new industries, driven by financial market planning and reform, are promised as medium-term solutions to structural challenges. But politics, like financial markets, is a short-term business, and Reeves could use some relief, starting with the useful inflation and growth figures due out next week.