The government has ruled out an intervention by the chancellor to help shore up financial markets’ weakening confidence in the UK economy, amid further falls in the value of the pound.

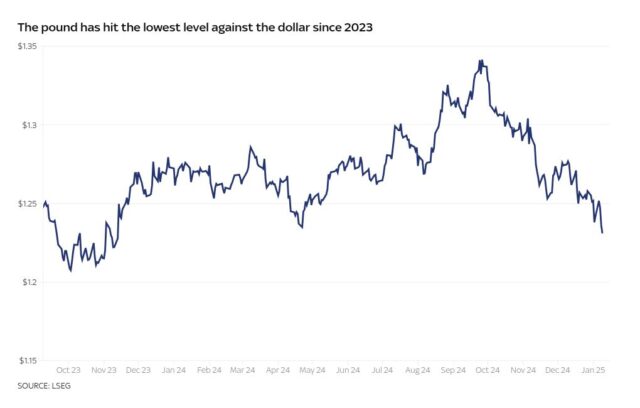

Sterling fell to its lowest level against the dollar since November 2023 early on Thursday, building on recent losses.

A toxic cocktail of concerns includes stagnating budget-linked growth, rising unemployment and the effects of high interest rates to help contain rising inflation.

They have also been confirmed by a jump in the UK’s long-term borrowing costs, which affected levels not seen since 1998 earlier this week.

Latest on money: Major mobile provider to increase bills

It increases pressure on the chancellor as it signals that investors are demanding greater rewards in return for holding UK debt, adding unwanted costs to Mrs Reeves, who is borrowing money to invest in public services, on top of the budget tax burden. for companies and the rich.

The Conservatives were granted an urgent question in the House of Commons this morning that urged them to account for the shift in market reaction to their budget, which critics have warned will only hurt investment, jobs, wages and will lead to higher prices.

Treasury minister Darren Jones, who was sent to respond on his behalf, told MPs there were no plans to comment further beyond a Treasury statement issued on Wednesday defending the government’s approach.

Shadow chancellor Mel Stride urged Reeves to cancel his upcoming planned trade trip to China to allow a change of course to restore market confidence.

He claimed that Britons are having to “pay the price for another socialist government that taxes and spends its way into trouble.”

Jones responded that he would not take lessons from the Conservatives on how to manage the economy.

Read more: There is a lot of concern about the UK economy, but this is not a difficult time

Liberal Democrat leader Ed Davey demanded an emergency fiscal declaration from parliament that canceled the planned increase in employers’ national insurance contributions in April to boost economic growth and reduce interest rates.

In addition to the strain on sterling from Reeves’ tax and spending plans, the effect on the pound has been intensified by a strengthening dollar due to changing market expectations of fewer US interest rate cuts this year. anus.

Sterling is trading at $1.22, a level last seen in November 2023.

The spot exchange rate had reached $1.34 in September.

However, it has also fallen sharply against other countries’ currencies.

The pound is down one cent against the euro to €1.19 at the start of the week, falling six tenths of a cent in today’s market moves.

Long-term bond yields, which reflect perceived risk, hit their highest level since 1998 this week and other benchmark bond yields are also heading north.

The additional borrowing costs make it more expensive for Reeves to pay off the debt it is taking on.

It may mean he faces a choice between further tax increases – something he had previously ruled out – or spending cuts as higher borrowing costs take their toll.

The Treasury said in its statement: “No one should have any doubt that compliance with fiscal rules is non-negotiable and that the Government will have tight control over public finances.

“The UK debt is the second lowest in the G7 and only the OBR forecast can accurately predict how much room for maneuver the government has; Anything else is pure speculation.

“Promoting economic growth is the number one mission of this Government as we fulfill our Change Plan. Over the coming weeks and months, the Chancellor will leave no stone unturned in her determination to deliver economic growth and fight for working people. “

Read more from Sky Information:

Food prices will rise due to increased budget taxes

Bank of England currency printer receives takeover bid

But Matthew Ryan, head of market strategy at global financial services firm Ebury, said of the market moves: “This is a damning criticism of Labour’s tax policies, particularly the increase in employer NI contributions ( National Insurance), which businesses have already warned will lead to higher prices and worsening labor market conditions.

“We see wide-ranging repercussions from this sell-off in the bond market. On the one hand, weak demand for UK debt raises the risk of public spending cuts or further tax increases to balance the country’s finances, neither of which would be positive for growth. .

“High bond yields are also likely to be reflected in higher mortgage rates, which would further reduce household disposable income.

“These concerns have placed a high premium on UK assets and we would not rule out a further fall for sterling as a result.”