Samsung Electronics plans to boost its AI business in devices, aiming to outperform global market growth in the consumer electronics segment this year.

The global consumer electronics market for smartphones, TVs and home appliances will grow about 3% in 2025, Jong-Hee Han, CEO of Samsung Electronics, told CNBC’s Chery Kang.

Samsung, the world’s largest smartphone and TV maker, expects its mobile devices business to grow 4% to 5% this year, while growth in the TVs and home appliances unit is also likely to accelerate, said Han, also director of Samsung Electronics’ device eExperience (DX) division.

Samsung Electronics has been stepping up its efforts to connect your devices to artificial intelligenceinstalling AI chips in their refrigerators, washing machines and robot vacuum cleaners.

It has also been beefing up its AI features in its premium flagship smartphone models, such as the Galaxy S24 series, which has multiple AI-enabled features including current time translation of certain telephone calls in foreign languages.

This comes as Chinese brands like Huawei and Xiaomi have become serious competitors to Samsung by offering high-end smartphones at significantly lower prices.

Competition from Chinese companies is “useful” for Samsung and consumers, Han said during the interview, noting that the company aims to differentiate its products with more safety and convenience, rather than lowering prices.

AI chip delays

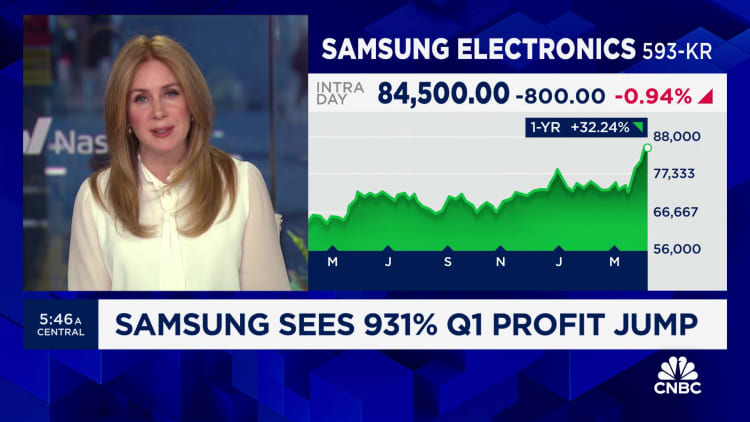

Samsung will reportedly issue its fourth quarter revenue and operating profit forecasts on Wednesday, before releasing quarterly results in late January.

Samsung operating profit for the December quarter expected to amount to 8.2 trillion won ($5.6 billion)according to Reuters estimates, a notable increase from the 2.8 trillion won it reported a year earlier, but down from 9.18 trillion won in the previous quarter.

In October, Jun, the head of the semiconductor division, issued a rare apology for the company’s disappointing third-quarter performance.

Last year, the South Korean giant’s shares plunged 32%, according to LSEG data, lagging the broader Kospi benchmark’s 9.6% loss.

The stock price “has never been this low before,” Han said during the interview, adding that the company has a “valuation” plan, aimed at increasing shareholder returns. The plan will be announced “one by one when it is in order,” he said, according to a CNBC translation of his Korean statement.

Investors expect Samsung to close the gap on HBM and get more serious about its “valuation” plan, Phillip Wool, head of research at Rayliant World Advisors, said in a note Monday, adding that the $10 share buyback trillion won The plan may help stabilize the stock price.

The company revealed a surprise plan in November to buy back shares worth about 10 trillion won over the next 12 months.

Citi analyst Peter Lee warned in a Dec. 31 note that a longer-than-expected delay in getting Nvidia approval for its HBM chips and weaker PC sales could continue to pose downside risks. He maintained a “buy” rating on the stock and cut his price target from 87,000 won to 83,000 won.